Digitalizing vehicle inspections while reducing the risk of fraud

Pacifico Insurance Company

Digital transformation | UX/UI | Service design

Summary

A chatbot was designed to help users inspect their vehicles after purchasing automobile insurance by sending pictures. Users can interact with the chatbot whenever and wherever they want, eliminating the need for in-person inspections in a busy city like Lima, Perú. This made vehicle insurance easier and faster, providing users peace of mind.

After the COVID-19 pandemic hit in 2020, this became the only channel for vehicle inspections, as it reduced unnecessary contact.

This initiative made Pacifico's vehicle area reduce inspection expenses by a third, and fraud was reduced by 80%. It also changed the way policies were renewed. Matching a vehicle's condition with the user's accident rate enabled Pacifico to charge clients more fairly, allowing those with a low incidence rate to pay less than those with a higher rate.

Team

Product owner: Vanessa Alcazar / Alheli Vilchez / Melissa Tardillo

UX/UI designer: Vanessa Morales

Design intern: Ivana Mulanovich

Frontend developer: Edinson Nuñez

Backend developer: Renzo Contreras

Business analyst: Juan Carlos Briones

Scrum master: Jorge Wust

Innovation architect: Yazmin Benza / Fiorella Ugaz

IT analyst: Christian Cunya

My contribution

I was the UX/UI designer in the end-to-end design process.

Responsible for coaching a new designer and a design intern.

Sharing the innovation lab culture and practices with product and business analysts was also crucial to promoting digital transformation in the company.

Context

About automobile inspections in Pacifico

The vehicle inspection service provided by the company had low satisfaction rates among clients and was not performing well from a business perspective due to fraud losses.

Additionally, the inspection process incurred high costs for the company. Rates varied between $12 for inspections in Lima and $18 in other parts of the country, amounting to $260K annually. However, some cities in Peru were inaccessible due to rugged terrain, making it impossible for in-person inspectors to reach them. As the inspectors were outsourced and not employees of the insurance company, clients grew mistrustful and hesitant to trust their vehicles and personal information to strangers.

Moreover, the company provided coverage for vehicles that had not undergone proper inspection or had not been inspected. This represented a considerable risk for the insurance company as they would have to cover car expenses without knowing their original condition. Over time, the number of cars that had accidents and were declared total losses increased. In 2017, Pacifico paid $500K in total losses, which were not a coincidence as these cars had recently acquired insurance but had never been inspected.

After analyzing all this data, the fraud and automobile product teams pitched the idea to the innovation lab to develop a solution.

Task

Create a digital vehicle inspection solution that would bring users a successful experience while helping manage fraud efficiently in the company.

Process

Ideation and definition

Research and workshop

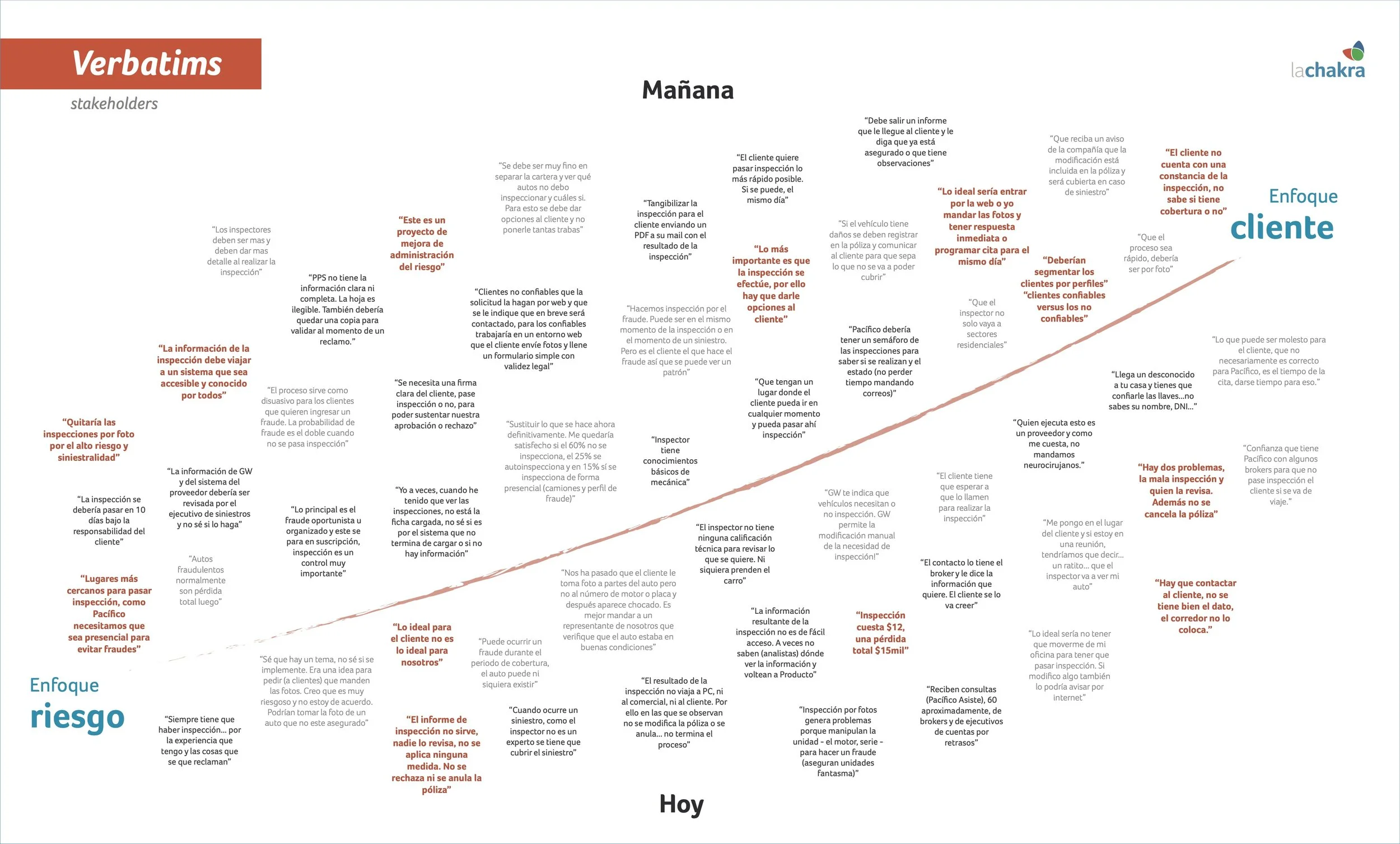

I conducted interviews with stakeholders, users, and brokers to gather qualitative data and gain a better understanding of the problem. This data was then compared to the quantitative data from the fraud and product teams. The results were used to organize a strategic workshop. The workshop aimed to share the main findings and objectives with the rest of the company, ensuring everyone was on the same page regarding the project.

Although it was primarily a vehicle project, we still required support and commitment from other company departments, such as risk management, marketing, and analytics. This workshop also helped us engage them at an early stage. This was crucial since we tackled projects in the innovation lab to solve them and promote innovation and digital transformation within Pacifico. Some of these initiatives could also trigger new projects in the future.

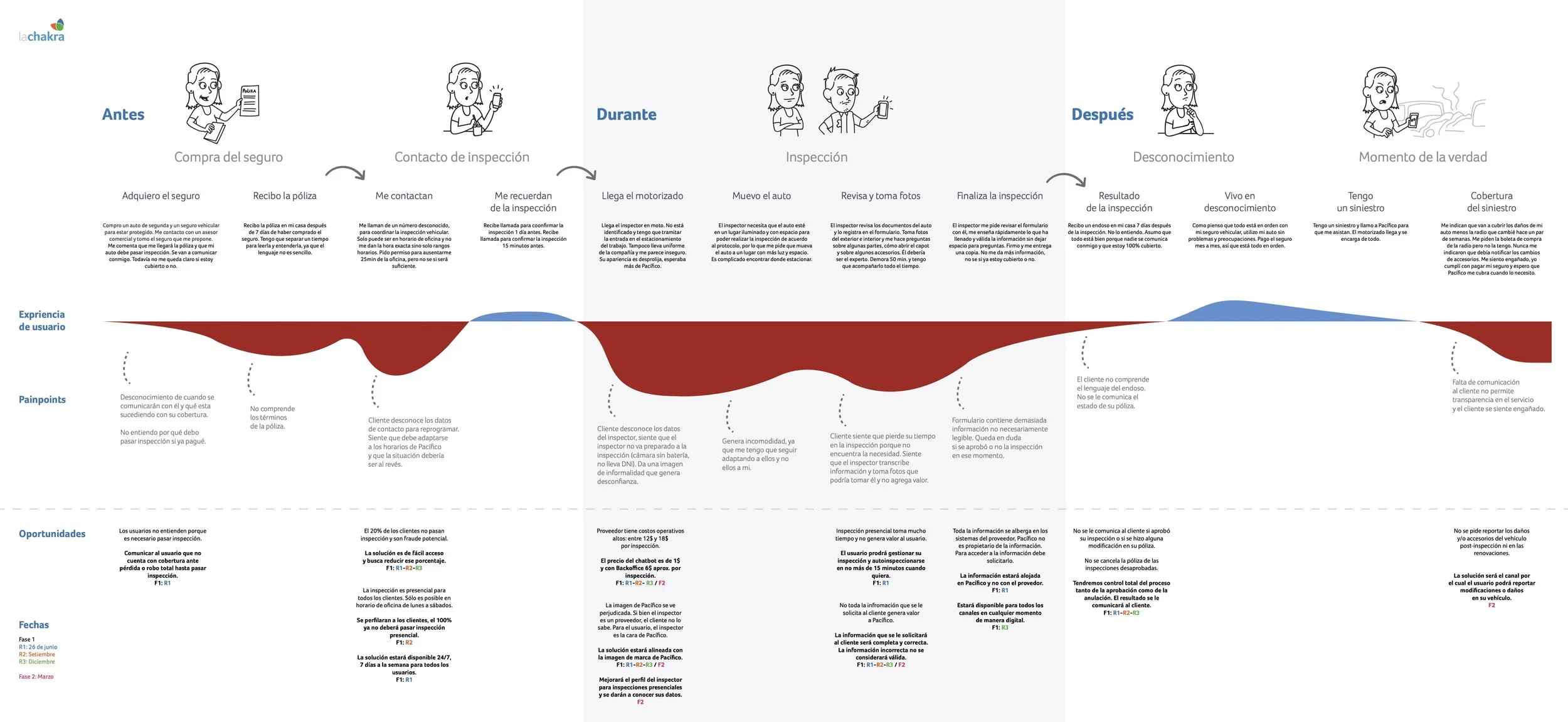

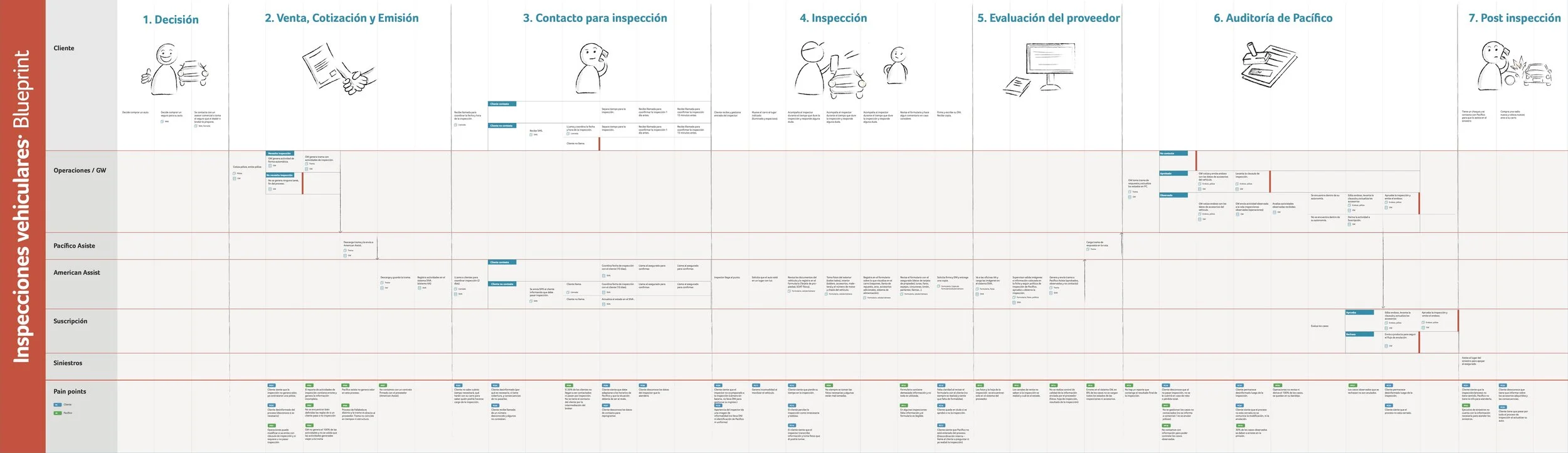

My team and I began the workshop by presenting design diagrams, including an inspection journey (A) and a service blueprint (B). During the presentation, we highlighted users' challenges while purchasing insurance - primarily, the lack of information. Additionally, arranging for an inspector to visit them and inspect their cars proved challenging, and they were hesitant to trust strangers for the same. Another pain point we identified was that Pacifico could not access the client's vehicle information, causing further inconvenience.

All this data concluded in four powerful insights (C) that helped anchor the project:

The trustworthiness of the Pacifico brand is being put to the test during an inspection process.

Users need to understand why inspections are necessary.

Time is critical to clients; they expect Pacifico also to value it.

Pertinent and appropriate communication guarantees clients peace of mind.

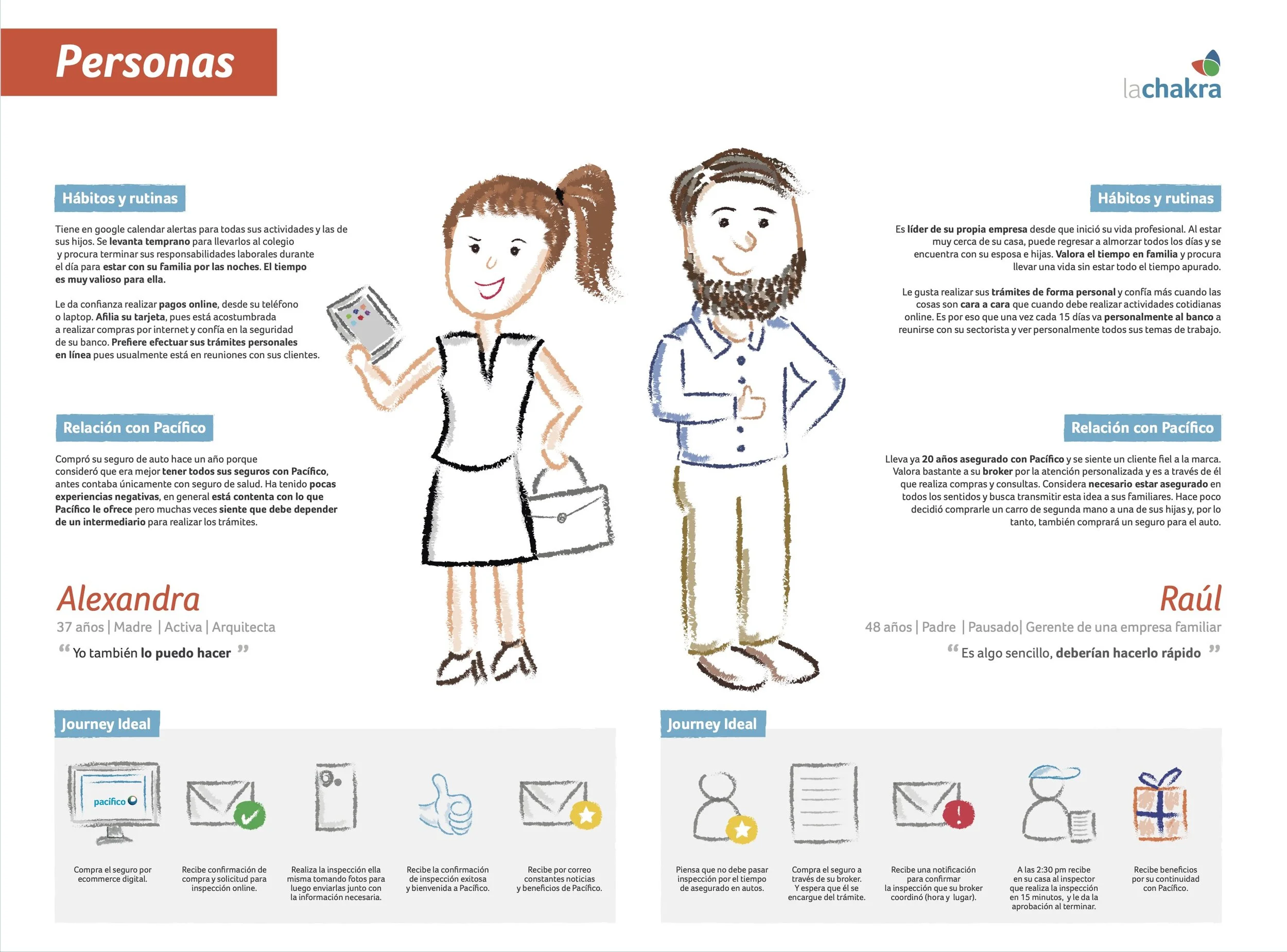

We concluded after the research and the stakeholders' verbatims (D) regarding their expectations. User Personas (E) helped us showcase how digital inspections would work and how they could coexist with the in-person process.

A. Journey As Is

B. Service Blueprint

C. Insights

D. Verbatims

E. User personas

Design, protoype and validate

Workshop results and prototypes

We gathered feedback from attendees and narrowed down the priorities to create a Minimum Viable Product (MVP). The MVP consisted of various components, such as email communication, online inspection with real-time assessment, a cloud repository for vehicle photos and information, updating information requested for inspection, customer profiling, and immediate approval when possible.

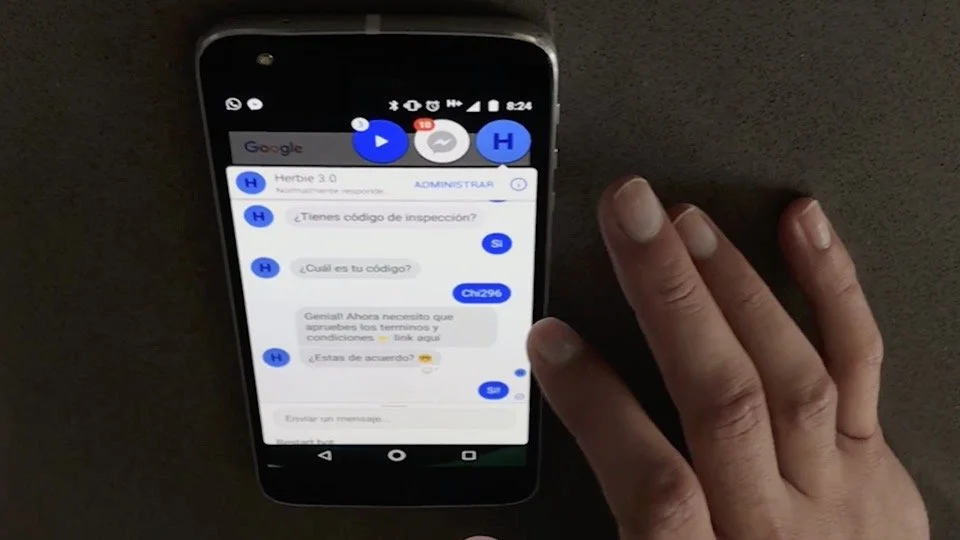

As a team, we designed a solution that included a front-stage chatbot and a back-office web. Users would inspect their cars by texting with a chatbot, and an expert in the back-office web would verify the information provided within 24 hours. This ensured optimal usability and user experience throughout the entire service.

We created prototypes without coding the solution first (B). This allowed everyone on the team to participate in building and iterating the solution quickly without risking any development work. We validated the prototypes with users and scaled them through every sprint (C&D).

Additionally, we had meetings with different company teams to ensure that the ecosystem needed for the solution to thrive was moving forward. We kept these teams up to date with learnings and results of user tests, project status, and next steps.

A. Chatbot and backoffice

B. Chatbot prototype

C. User testing

D. User testing

Launch

Launching and results

After the development of the chatbot, it was launched for a two-week trial period among friends and family before going live in December 2019. The chatbot "Pepe" exceeded the set satisfaction goal of 80%, achieving 88% in December and 89.2% by January. Moreover, the inspection cost was set to $6, but it ended up costing just $3.

Although some areas still needed improvement, the project was considered a success for the automobile business in Pacifico and a significant milestone for the innovation lab. This was the lab's second project, and this experience helped us gain the trust of essential company members, positioning the lab as Pacifico's primary ally in digital transformation.