Shifting the process of collecting life insurance benefits towards a more human approach.

Pacifico Insurance Company

Digital transformation | Service design

Role

I worked as a service designer on this project, which didn't involve a digital product like my previous projects in the lab.

My leading role was to guide the life insurance team throughout the project. This involved tasks such as reaching out to beneficiaries and insured parties, defining the project concept, and designing a solution that considers the expectations of insurance creditors. Finally, I oversaw the implementation of the project to ensure it was successful.

Team

Product Owner: Luis Morales

Life insurance team: Shirley Rodriguez, María Fernanda Tupayachi and Erick Reusche

Innovation drivers: Pedro Larriega and Yashmine Benza

Service designers: Naomi Nathan and Vanessa Morales

Problem

When a close person passes away, life insurance beneficiaries receive a large sum of money. However, the service experience for this process was unsatisfactory.

Around 62% of policyholders received their insurance money after waiting almost a year, mainly due to the complicated and lengthy document verification process. To avoid any possibility of fraudulent claims, Pacífico (the insurer) required a large number of documents to be submitted, even though the number of fraud cases was less than 1%. Unfortunately, this stringent procedure deprived many beneficiaries of their life insurance benefits and delayed the entire claim process.

Many beneficiaries of life insurance policies are unaware that the policyholder has purchased this product. As a result, when the policyholder passes away, the beneficiaries are left unaware of what to do next. Similarly, the policyholders may not have updated their beneficiaries over time, so the intended person may not receive the benefit.

Task

Improve the experience of life insurance beneficiaries and ensure the efficient collection of their benefits.

Context

The marketing team had collaborated with a consulting firm outside the company to initiate a project. The primary goal of this project was to find a commercial solution to the problem the beneficiaries faced while collecting their insurance. However, the consulting firm failed to contact any beneficiaries, which led the team to make assumptions about the user's needs and expectations. The results left the life insurance area unsure, so the team leader sought advice from the innovation laboratory.

Process

Research

After the innovation lab took charge of the project, we conducted the research again. We knew contacting the beneficiary could be challenging as they had recently received a large sum. Therefore, we relied on insurance advisers who were close to them. They could introduce us to the beneficiaries if they wanted to participate in our research. At the same time, we contacted beneficiaries of other insurers and recent life insurance creditors to understand how other services were operating.

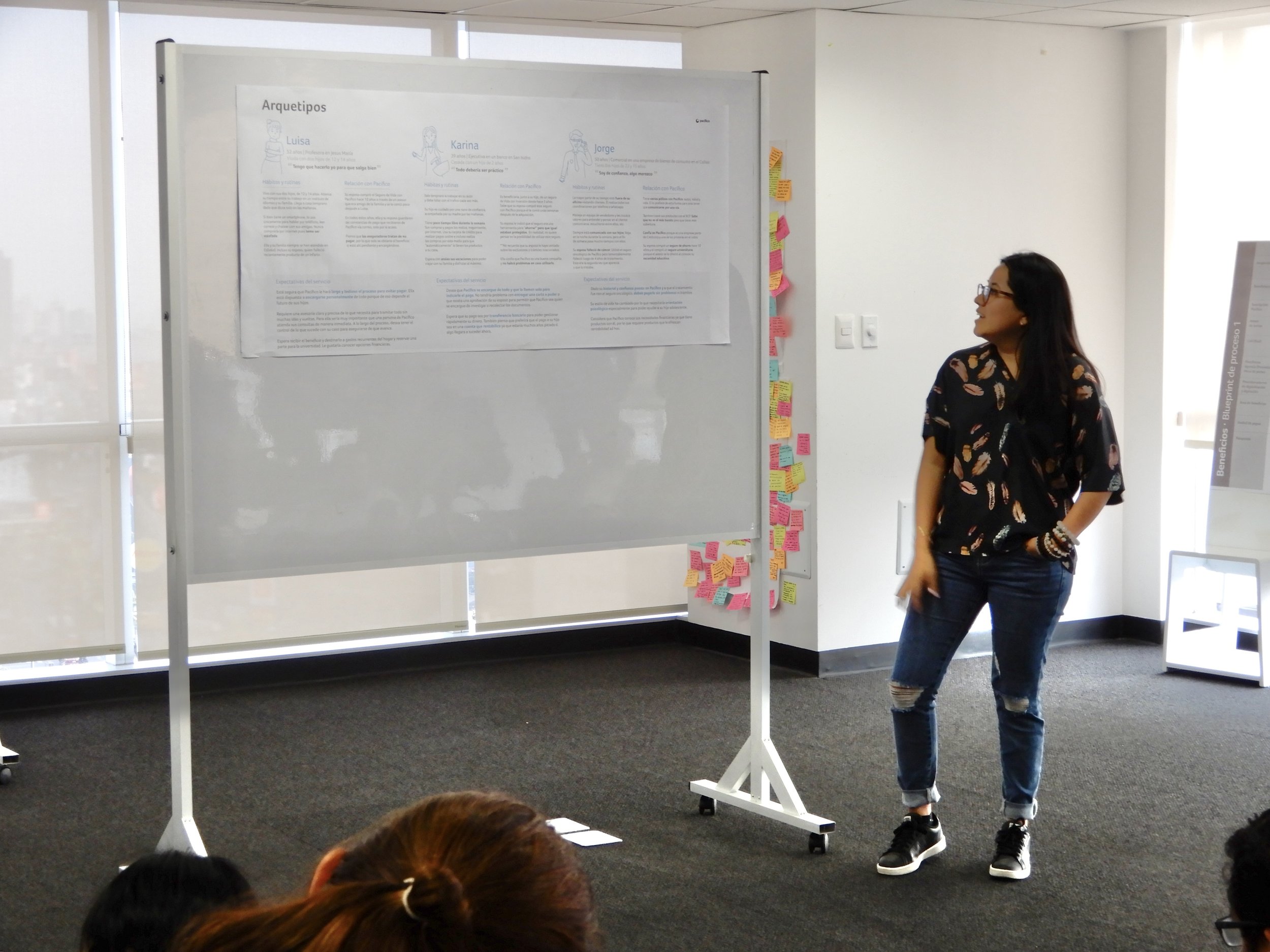

Strategic Workshop

The primary objective of the workshops was to ensure that all participants had a shared understanding of the new future experience for collecting a life insurance benefit. We presented the interview results after talking with life insurance holders and beneficiaries. Additionally, everyone participated in a prioritization activity to co-create the ideal solution for the project.

Solution

The life insurance team that participated in the project implemented the service in their area. We defined new rules to automate the payment to beneficiaries whose policyholders had had life insurance for an extended period. We decided to ask for minimum documentation only for cases whose policyholders had held the insurance for a short period since fraud was common mainly in these cases.

For disability cases, we facilitated digital documentation, signature, and benefits transfer to avoid commuting for the beneficiary, who was also the policyholder.

Telephone channels opened as an alternative to in-person communication, and Pacífico clinic advisors took on a more proactive role. They began informing their beneficiaries about the life insurance benefit that would become available in the event of the policyholder's death.

After six months, life insurance collections reduced the average settlement period to 14 days and 21 days in complex cases.